Table of Content

They focus on the points shoppers care about most — worth, customer support, coverage options and savings opportunities — so you can really feel assured about which supplier is best for you. She is really keen about serving to readers make well-informed selections for his or her wallets, whether the goal is to find the proper comprehensive auto policy or the most effective life insurance coverage policy for his or her wants. Allstate makes discovering a local agent within the Sunshine State straightforward, offering the option to search on-line by ZIP code or city.

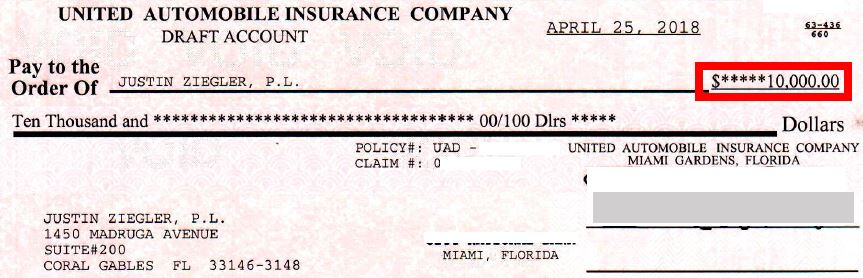

Based on our findings, State Farm, Geico, Progressive and Allstate supply a variety of the greatest car insurance coverage in Florida. Florida legislation requires drivers to carry a minimal of $10,000 in bodily injury liability and property damage protection. However, you probably can at all times increase the policy's coverage limits to fit your needs. Despite the variations between private auto and business auto insurance coverage, the kind of insurance required in Florida is dependent upon the car’s usage and its ownership construction.

What The Direct Writers Don’t Want You To Learn About Auto Insurance Coverage

A driver may be sued if they brought on severe impairment of physique function, everlasting critical disfigurement or dying. Auto insurance coverage corporations in Michigan can apply a deductible to PIP claims, meaning you’ll have to pay the deductible quantity earlier than insurance pays. Managed care does not apply to emergency care, that means you don’t need to get pre-authorization to go to the emergency room after a automobile accident. This option is intended to economize, however contemplate the unlimited choice should you don’t like managed care. PIP is required in 15 states as part of “no-fault insurance” laws, which typically require you to make smaller injury claims by yourself PIP insurance.

Florida’s higher-than-average premiums could be due to severe climate, the state’s relatively high price of uninsured motorists or a combination of both. Low-risk Liberty Mutual prospects on this state can anticipate to pay between $431 for minimum coverage and $1,075 most coverage, while higher-risk drivers could pay between $3,251 and $4,987. To help customers select the proper protection limits and premiums, Liberty Mutual's web site presents an easy-to-use coverage calculator. Bankrate’s insurance coverage editorial group understands that whereas reasonably priced premiums are essential, they aren’t the one consideration when in search of one of the best car insurance coverage coverage. Auto Insurance Study, together with coverage options, cell accessibility and more, and issue these and different knowledge factors into our proprietary Bankrate Score, which has a possible total of 5.zero factors.

Consider Telematics Insurance

PIP is an elective coverage in 4 states and the District of Columbia and never out there in other states. If you’re seeking complete insurance, Nationwide is another fantastic various. They present a broad vary of insurance policies to select from, and they’re acknowledged for their nice client care and claim service.

If you can’t work as a outcome of accident for no much less than 14 days, PIP will cowl 70% of lost wages, up to a maximum fee of $3,000 per month and a complete most cost period of fifty two weeks. If you don’t work but can now not carry out companies at residence, similar to a stay-at-home parent, PIP will pay up to $30 a day so that you can hire someone for essential providers, up to fifty two weeks. Parents of minor youngsters can get $25 a day for youngster care, up to $750 total. Because PIP claims are paid no matter who triggered the accident, there’s no waiting round for a legal responsibility lawsuit in opposition to someone else to be resolved.

Florida Car Insurance Coverage Firm

This profile, assessed throughout greater than 35,000 ZIP codes in the us, provided a basis on which drivers may examine every supplier. AmTrust Financial has seven company places of work positioned across a few of the largest cities in Florida, including Jacksonville and Ft. The firm is the 14th largest author of auto insurance in the country. Prospective policyholders ought to be conscious that AmTrust Financial does not present direct quotes to clients. If you're interested in an auto insurance coverage, you'll have to talk to an independent agent that sells insurance policies for the company. Progressive is a serious firm, underwriting 15% of all auto insurance coverage policies in Florida.

The deductible is what you pay out of pocket earlier than your insurer covers a percentage of your declare. Geico sells no-frills insurance policies covering just the basics at prices nearing the higher finish of the spectrum. Nevertheless, it offers a broad range of reductions to make its insurance policies more inexpensive, including exclusive financial savings opportunities for active-duty army members and veterans. Car Insurance Satisfaction Study for Florida, yet the insurer was featured in most different states scoring just under the regional common for general buyer satisfaction.

Geico

Farmers is a well-liked insurance coverage company, and so they supply several totally different protection choices. They’re known for his or her reasonably priced charges, and so they offer a number of discounts to help you lower your expenses. State Farm is the largest vehicle insurance coverage company in the country, and it’s no surprise that they’re additionally one of many high firms in Florida. They provide a extensive variety of coverage choices, and they’re known for his or her nice customer support. Yes, your credit-based insurance score will generally impression how a lot you pay for auto insurance coverage in Florida until you choose a service that doesn't utilize credit score in its underwriting standards. Generally, drivers with poor credit score scores will pay greater premiums, as a result of a better statistical likelihood of filing a claim.

Yes, you ought to use your personal Florida automotive insurance when renting a automobile, so you may not need to buy extra protection from the rental automobile company. However, private automobile insurance will only cover a rental automotive used for personal travels. You should get business protection if you want to lease the car for enterprise functions.

Business-owned vehicles have higher dangers as a result of they are pushed more and used extra frequently than personal vehicles. Due to the upper chances of industrial autos moving into an accident, industrial auto insurance coverage usually has higher automotive insurance coverage premiums than personal auto insurance coverage. Taxis are required to hold bodily injury legal responsibility protection of $125,000 per individual, $250,000 per incidence, and $50,000 in property injury legal responsibility. Many drivers likely want to be lined under the most effective Florida car insurance coverage firm they'll find.

It presents impartial information for the aim of offering consumers insight into acquiring the insurance coverage protection and dealing with the insurance firm that finest meets their needs, subject to underwriting. No point out of a specific insurance coverage company or its prices is a suggestion for insurance coverage, and all users and applicants shall be topic to any and all underwriting requirements by the insurance coverage firm to which they apply. The materials on this web site has been prepared for data and education functions solely.

No comments:

Post a Comment